Table of Contents

- How to File a Tax Extension in 2024

- Tax Deadline 2024 Extension Form - Ardyce Lindsay

- How To File A Tax Extension | A Complete Guide [INFOGRAPHIC]

- How Many Times Can You Ask For An Extension On Your Taxes?

- How to file a tax extension with the IRS | Fortune

- How to File a Tax Extension 2018: Here's How to Get an Extra 6 Months ...

- Irs-Tax-form-Filing-Extension - Williams & Schiller, CPAs & Consultants

- Step By Step Extension Instructions | Legal Tax Defense

- How to File for a Tax Extension in 2023 | JNA Dealer

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

What is IRS Free File?

Why File an Extension?

![How To File A Tax Extension | A Complete Guide [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/03/20190222-Tax-Relief-Center-How-To-File-A-Tax-Extension.jpg)

How to File an Extension through IRS Free File

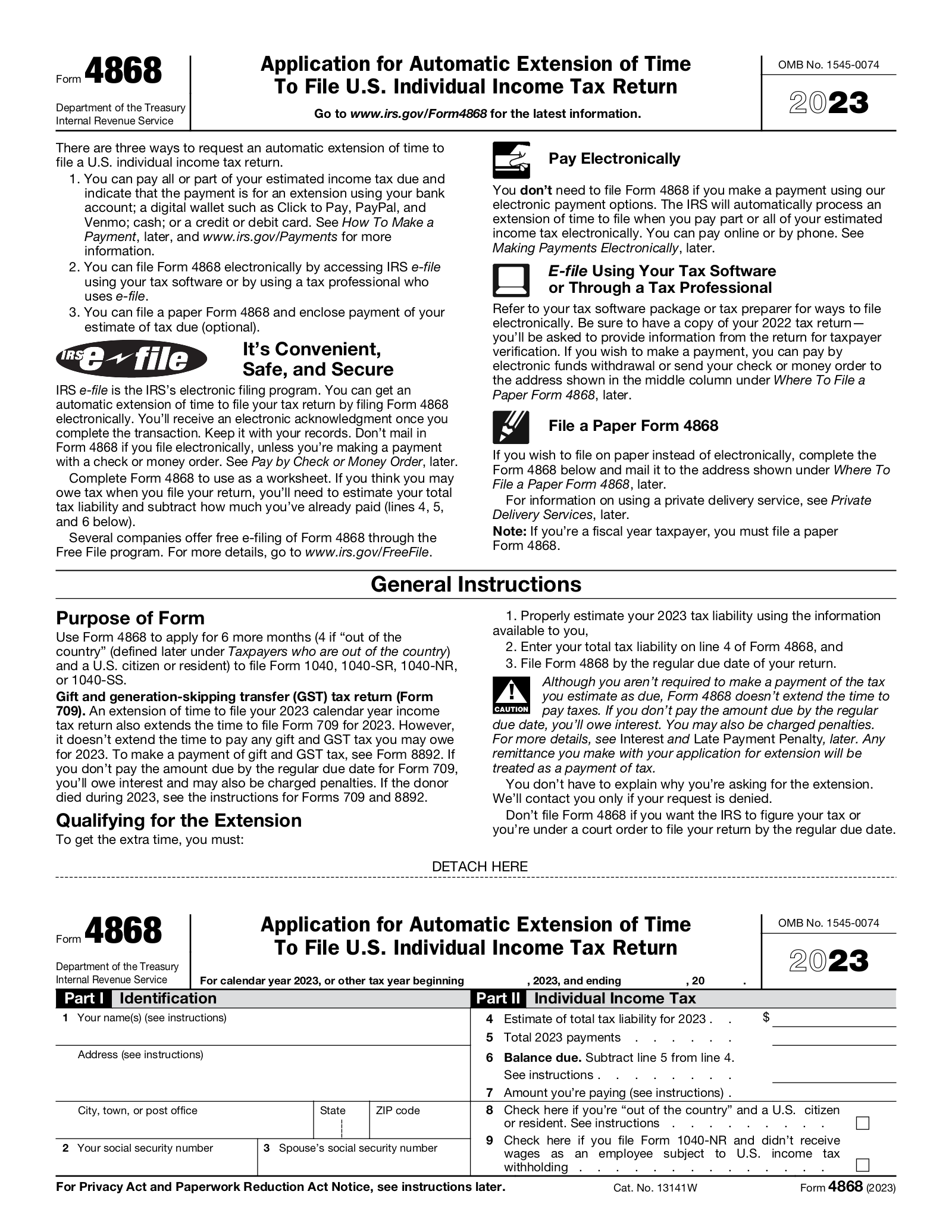

Filing an extension through IRS Free File is a straightforward process. Here are the steps you need to follow: 1. Check your eligibility: Make sure you meet the eligibility requirements for IRS Free File, which include earning $69,000 or less per year. 2. Visit the IRS website: Go to the IRS website at www.irs.gov and click on the "Free File" tab. 3. Choose a tax preparation software: Select a tax preparation software from one of the participating companies, such as TurboTax or H&R Block. 4. Prepare your tax return: Use the tax preparation software to prepare your tax return, but do not submit it. 5. File Form 4868: File Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, which will give you an automatic six-month extension. 6. Submit your extension: Submit your extension request through the tax preparation software, and you will receive a confirmation of receipt.